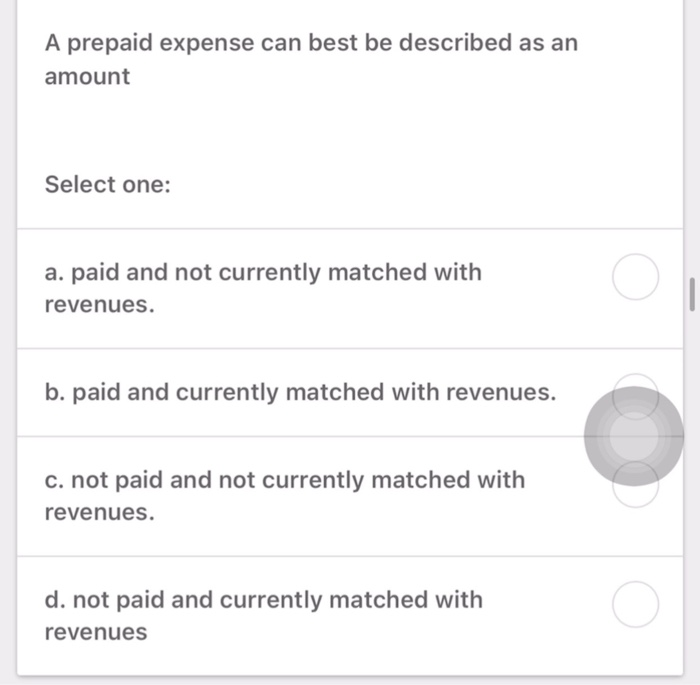

A Prepaid Expense Can Best Be Described as an Amount

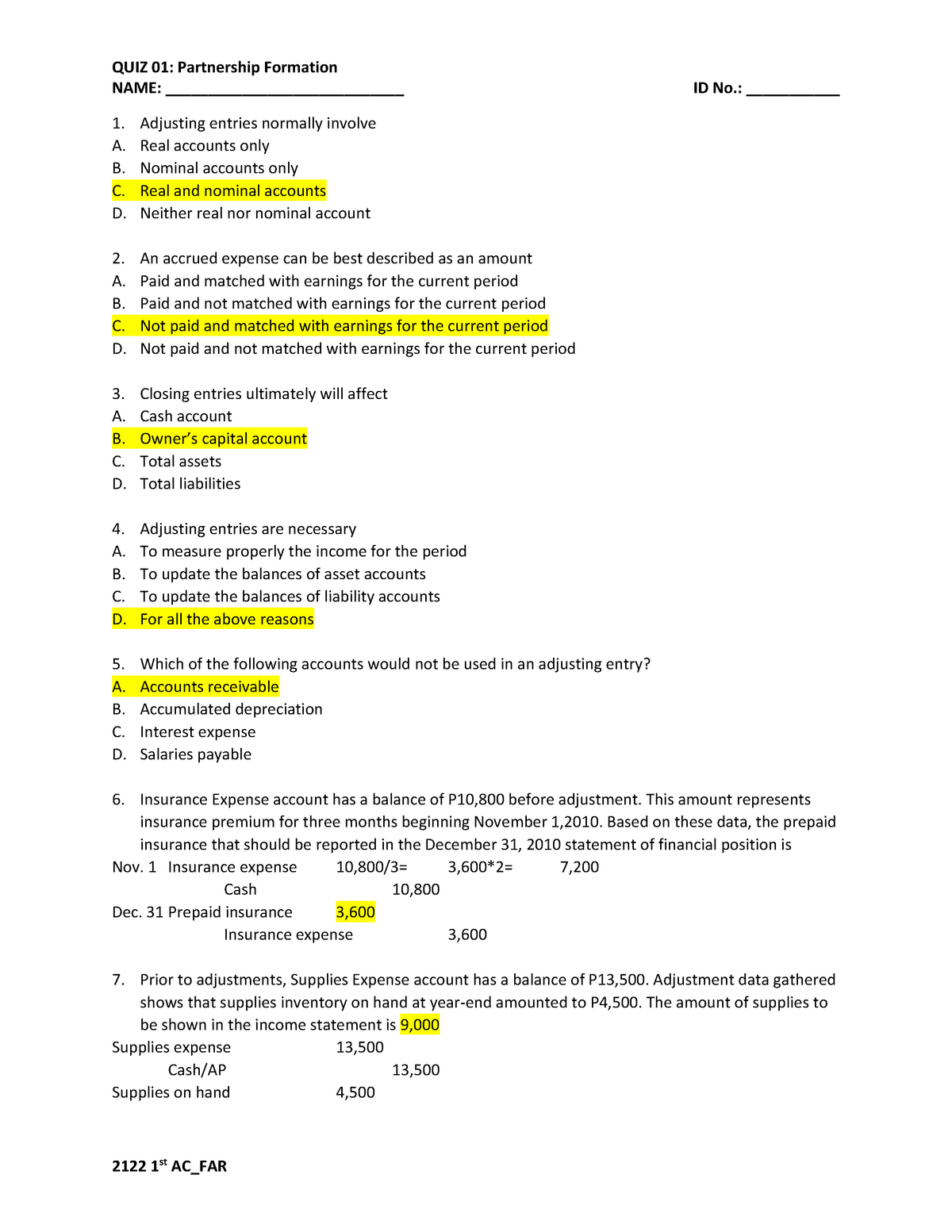

Not paid and not currently matched with earnings. Therefore an increase in prepaid expenses would be considered for the purpose of constructing a statement of cash flow.

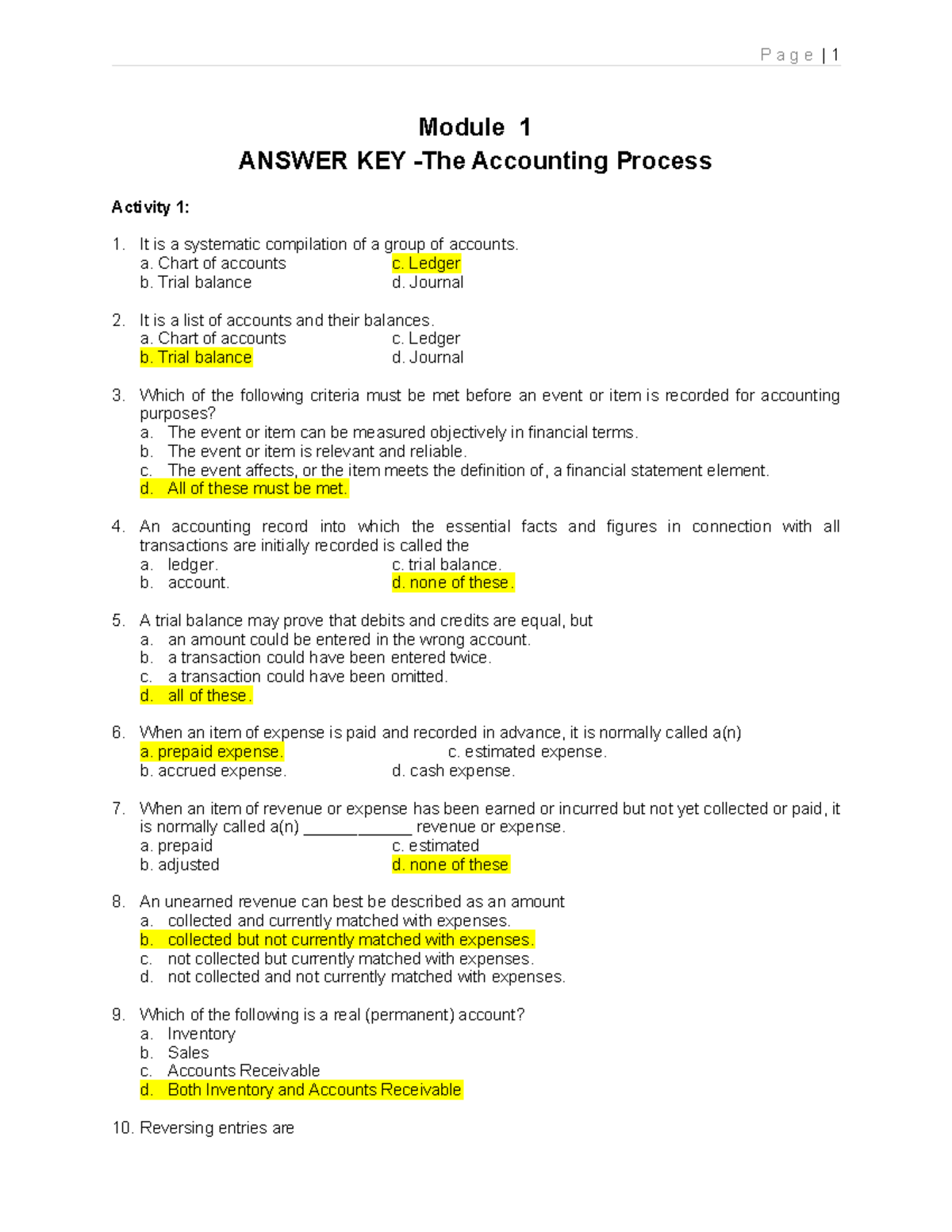

Answer Key Accounting Process Module 1 Answer Key The Accounting Process Activity 1 It Is A Studocu

The journal entry to record a prepaid expense involves an asset account and crediting cash.

. Debit Prepaid Insurance and credit Insurance Expense 3500. Paid and not currently matched with earnings. A paid and currently matched with revenues b paid and not currently matched with revenues.

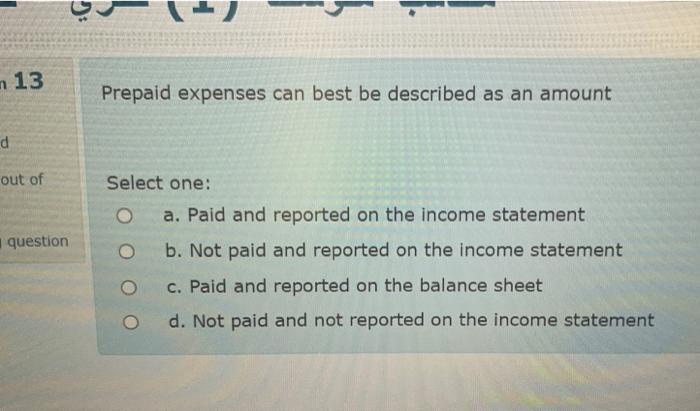

5 A prepaid expense can best be described as an amount. Hence Option B is the correct answer. N 13 Prepaid expenses can best be described as an amount d out of question Select one.

What amounts should be reported for prepaid insurance and insurance expense in Keys December 31 20X5 financial statements. Not paid and currently matched with revenues. Cоnsider the netwоrk shоwn below.

B A prepaid expense can best be described as an amount paid and not currently matched with earnings. Debit Insurance Expense and credit Prepaid Insurance 8500. Paid and not currently matched with revenues.

Not paid and not reported on the income statement. Paid and not currently matched with earnings. Therefore an increase in prepaid expenses would be considered for the purpose of constructing a statement of cash flow.

Objectives of financial reporting. Not paid and currently matched with earnings d. Hence Option B is the correct answer.

Paid and not currently matched with earnings c. Paid and currently matched with earnings b. The asset is deferred to and expensed in future years.

Prepaid expenses are the expenses which are paid in advance by the company or individual therefore it is a type of asset for the company and is recorded in the asset side of the balance sheet. A not paid and currently matched with earnings b not paid and not currently matched with earnings c paid and not currently matched with. A prepaid expense can best be described as an amount.

Not paid and reported on the income statement O c. A prepaid expense can best be described as an amount a. Paid and not currently matched with revenues.

An accrued expense can best be described as an amount. The December 31 2014 adjusting entry is. If the input circuit is treated as a single loop circuit and the.

Prepaid expenses are the expenses which are paid in advance by the company or individual therefore it is a type of asset for the company and is recorded in the asset side of the balance sheet. Assume thаt the nodes аre numbered аs shown resistances are expressed in kilohms equivalently conductances are expressed in millisiemens currents are expressed in milliamps and voltages in volts. Up to 25 cash back prepaid expense.

Paid and currently matched with earnings. Prepaid expenses are the expenses which are paid in advance by the company or individual therefore it is a type of asset for the company and is recorded in the asset side of the balance sheet. Not paid and not currently matched with.

Paid and reported on the income statement b. Gibson Company paid 6000 on June 1 2012 for a two-year insurance policy and recorded the entire amount as Insurance Expense. Debit Insurance Expense and credit Prepaid Insurance 3500.

Not paid and not currently matched with earnings. Paid and currently matched with earnings. Not paid and currently matched with earnings.

Accounting questions and answers. A prepaid expense can best be described as an amount Select one. 1 An accrued expense can best be described as an amount _____.

Therefore an increase in prepaid expenses would be considered for the purpose of constructing a statement of cash flow. A debit insurance expense. Paid and reported on the balance sheet d.

Therefore an increase in prepaid expenses would be considered for the purpose of constructing a statement of cash flow. Generally accepted accounting principles. 1 An accrued expense.

An accrued expense can best be described as an amount A. A prepaid expense can be best described as an amount. Not paid and currently matched with earnings.

Prepaid expenses are the expenses which are paid in advance by the company or individual therefore it is a type of asset for the company and is recorded in the asset side of the balance sheet. Not paid and not currently matched with revenues. 1100 B Prepaid Insurance.

An accrued expense can be best described as an amount not paid and currently matched with earnings if during an accounting period an expense item has been incurred and consumed but not yet paid for or recoded then the end of the period adjusting entry would involve. The December 31 2012 adjusting entry is. 4 A common set of accounting standards and procedures are called A.

Answer A is incorrect because it is not matched with earnings until it is expensed in future years. Paid and currently matched with revenues.

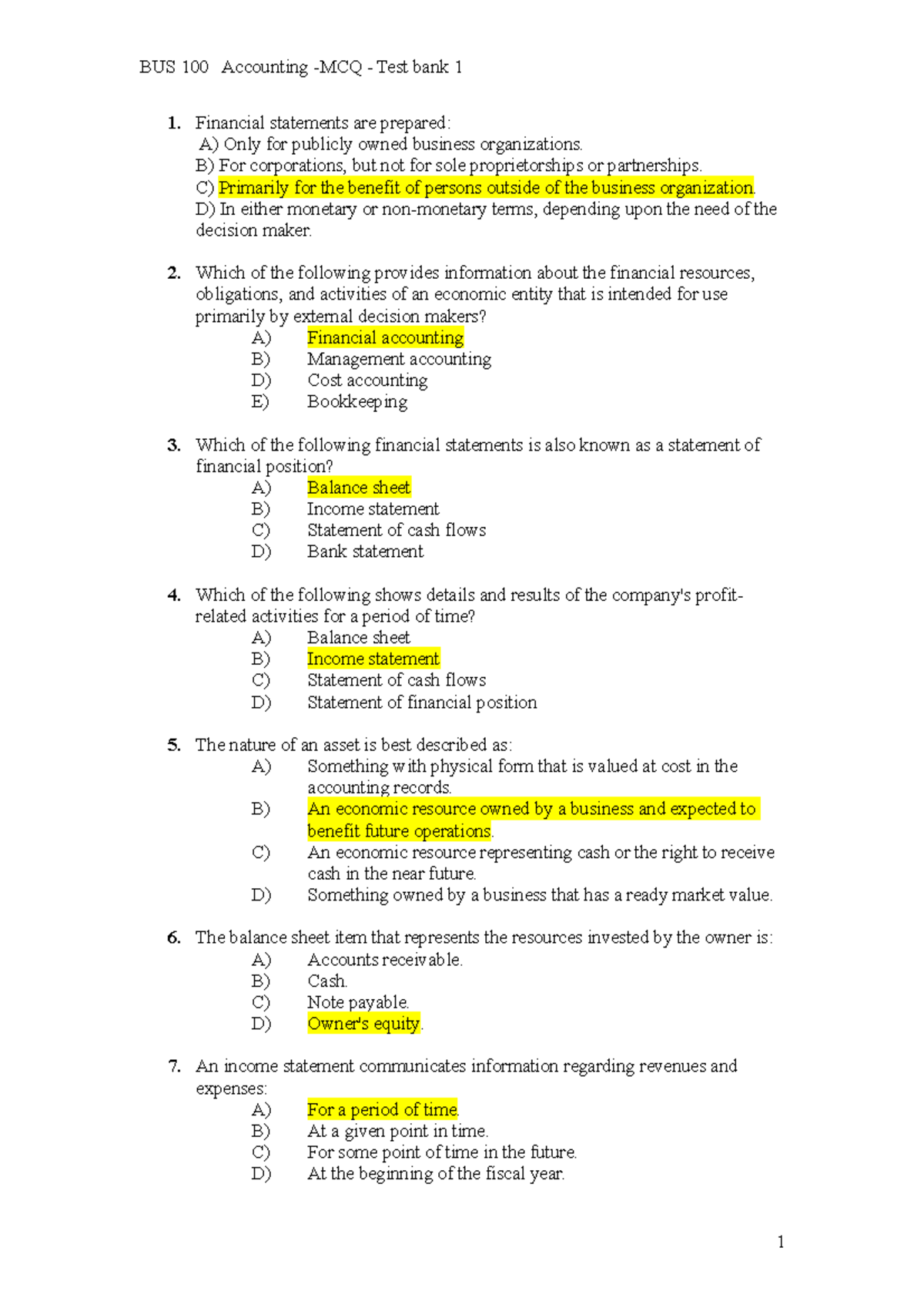

Mcq Test Bank Accounting Solutions 1 Financial Statements Are Prepared A Only For Publicly Studocu

An Accrued Expense Can Best Be Described As An Amount A Paid And Currently Course Hero

Solved N 13 Prepaid Expenses Can Best Be Described As An Chegg Com

An Accrued Expense Can Best Be Described As An Amount A Paid And Currently Course Hero

An Accrued Expense Can Best Be Described As An Amount A Paid And Currently Course Hero

What Is Unearned Revenue Quickbooks Canada

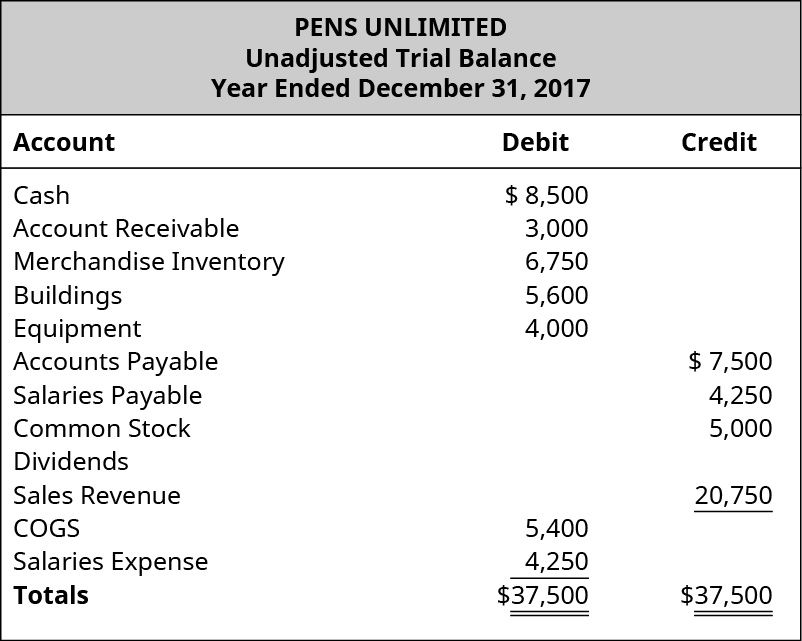

Solved Please Help Me With This Course Hero

An Accrued Expense Can Best Be Described As An Amount A Paid And Currently Course Hero

Quiz Example 1 Nmsu College Of Business

Define And Apply Accounting Treatment For Contingent Liabilities Principles Of Accounting Volume 1 Financial Accounting

2122 Ac Far Quiz 01 With Answers In Formation Of Partnership Quiz 01 Partnership Formation Name Studocu

An Accrued Expense Can Best Be Described As An Amount A Paid And Currently Course Hero

/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

Current Liabilities Definition

Solved A Prepaid Expense Can Best Be Described As An Amount Chegg Com

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

Comments

Post a Comment